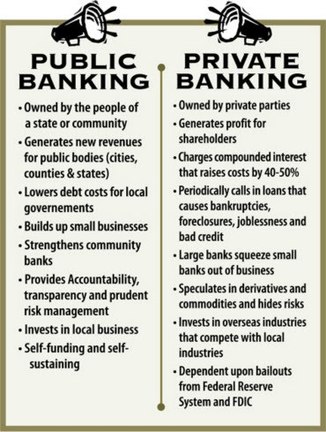

We need a Public Banking System that is dedicated to serving your local economy and ensuring community sustainability.

A Banking System;

- That prioritises supporting and lending to small businesses and households in its region.

- That has no private owners or shareholders.

- That is regionally bound and focused on its region’s prosperity and competitiveness.

- That is a safe place for deposits.

- That returns any surpluses to the community. No bank profits are taken out of the community.

- That uses local deposits to fund local loans, keeping capital available and working locally.

- That utilises local community stakeholders to help inform Community Bank priorities.

- That is owned by the people of the region rather than by government to prevent party-political interference.

- That has a legal structure that prevents it being bought, sold or taken over.

- That does not partake in securitisation or speculation; lends for productive purposes only.

Local Community Banks – LocalFirst CIC (UK)

Local First (Promoting local banks Local First CIC is a not-for-profit, Community Interest Company)

We have a Choice:

- We can follow current government policy and continue to restore the 3 bailed-out too-big-to-fail commercial banks, keeping the failed oligopoly going. (AIB; 99% state owned, on life-support & owes us what..€20.8bn? The BoI essentially told government to butt out. So they may, ‘they’re a private entity’) or

- We can, for a total of €140m over a five year period, establish 10 safe, solvent and ethical Regional Public Banks with the explicit purpose of serving local businesses, communities and households. The Credit Unions and Post Offices can play a key role in providing the Community Banking System we need. The Credit Unions need to look at radical survival options as their future is under serious threat.

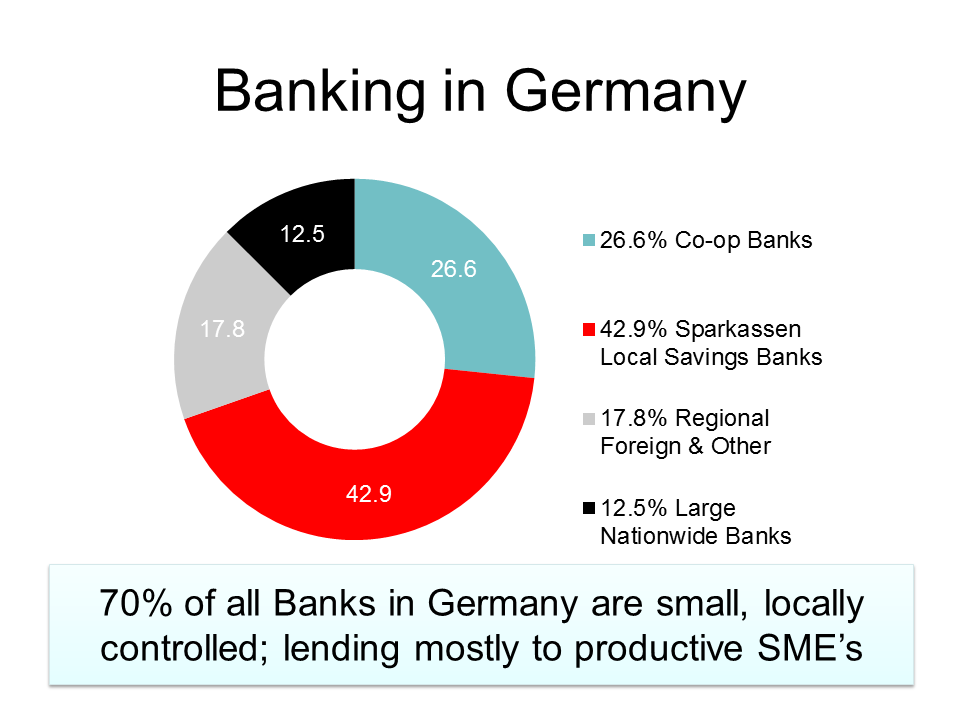

Germany has almost 70% Public Banks; 42% Public Savings Banks (Est. 1778) 417 Independent Public Banks with 15,000 branches and 26% – 1,050 Co-op Banks.

- They are the backbone of the successful German economy; the fourth biggest in the world.

- They serve the community and prioritise lending to small and medium size local businesses.

- They are regionally bound and regionally focused and prioritise the prosperity of their region.

The Private Commercial Banks in Germany have only 12.5% of the market:

In Ireland 3 Banks have over 90% of the market. AIB is 99.9% State owned but owes in the region of €20bn, that we may never receive.

A Regional Public Banking System for Ireland

2016 Election Campaign for Regional Community Banks

It really is time to repair Ireland’s blighted banking landscape with a dedicated network of regional public banks.

The plan for Ireland is to initially establish two or four pilot Regional Public Banks which will be used to refine and perfect the business model.

The remaining banks will be established over the following years.

It is proposed to use the Post Office Network as service outlets for the Regional Public Banks.

Plug The Hole

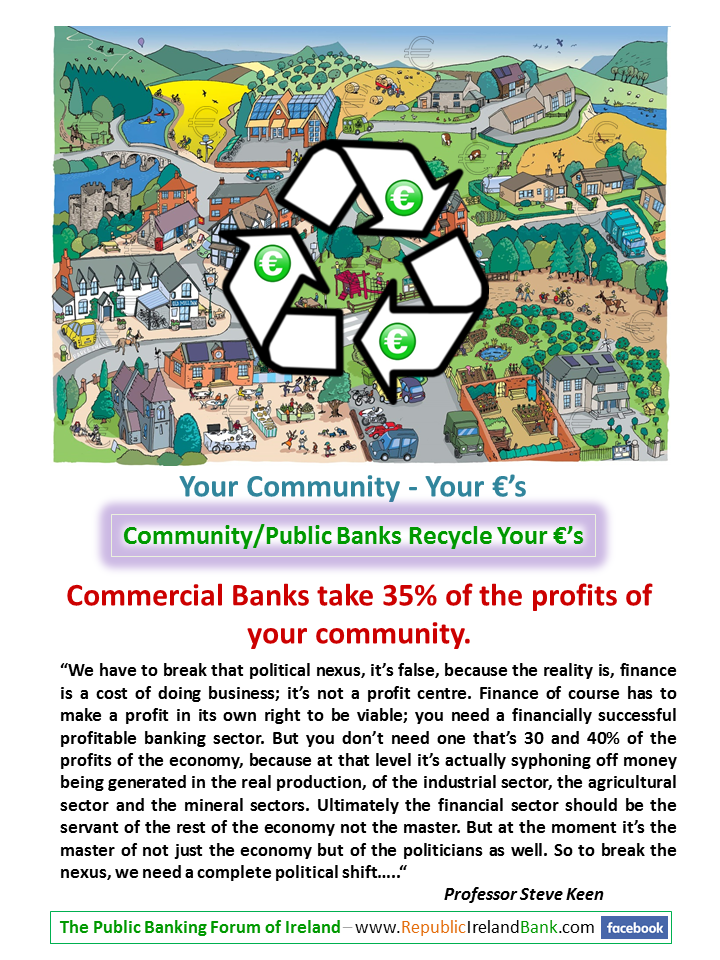

Establish a Public Banking System that does not suck 30% to 40% of the profits of the economy.

A phenomenal success story of New Zealands Post Office Bank – Founded May 2001.

Their Slogan is – It’s Ours!

New Zealand Post Office Bank – Est. 2001- A phenomenal success story.

Independence – Kiwibank

Ellen Brown Web of Debt

North Dakota is one of only two states that are currently able to meet their budgets, and it has the lowest rate of unemployment in the country. The secret of its success is that it is the ONLY STATE THAT OWNS ITS OWN BANK. For 90 years, all the state’s revenues have gone into the Bank of North Dakota (BND), which then leverages these deposits into many times that sum in loans, as all banks are legally allowed to do.

The BND is a great model for California and others state, county and city governments to follow in forming their own banks, as the legislation has been well established for many decades. The BND is not at the mercy of Wall Street but is controlled locally, serving to protect North Dakota from the credit freeze and from the need to sell off its precious resource

The Central Bank of Ireland; Public or Private?

Working in the public interest?

In 1939 Seán T O’Kelly was appointed Minister of Finance.

He secured the passing of The Central Bank Act1942.

On July 17th 1942, at the fifth and final stage of the Dáil debate on the “Central Banking Bill”, he argued that the owner of the credit issued by the Central Bank of Ireland should be the private property of the joint stock banker and not the property of the people of Ireland.

This debate was carried, with just five TDs present in the Dáil.

- The owners of the credit (the country’s money supply) issued by the CBoI is the private property of the stock bankers, not the people of Ireland.

- The Irish people do not own the countries money supply. It is the private property of the CBoI stock bankers.

- The CBoI is now controlled by the unelected & unaccountable ECB.

- Up to the passing of The Central Bank Act1942 credit creation was controlled by Currency Commission.

Does it matter?

The passing of The Central Bank Act1942 has meant that all credit/money since has been issued by the CBoI as debt with interest due on it through the Private Banks in Ireland; the only exception to this is the 3% to 4% notes and coins in the economy, 96% of money in the economy is now electronic; digits on a computer.

The interest paid to private banks is taken out of the community and often out of the country. Interest averages out between 35 to 45%, ranging from 12% on refuse collection to 75% on rented accommodation. (Prof Margrit Kennedy)

The US FED

An excellent video by Eustace Mullins:

In the video he speaks about the setting up of the FED (The US Central Bank) in 1913 under very similar dodgy circumstances.

Eustace Mullins Video – The Magical Money Machine

Retrieving the situation in Ireland:

The creation of credit for the benefit of the people, lost to the CBoI in 1942 and later transferred to the ECB, is returned to the people by the introduction of Public Banks.

The interest charged on loans from the Public Bank is used for two purposes;

- To increase equity in the Public Bank (No bonuses paid) and

- Any excesses are returned to the community in the form of grants for social projects. (No private shareholder return)

The interest charged by a Public Bank is essentially just a fee as there is no private profit gained from it and no private profits are taken out of the community.

The credit can be focused towards the productive needs of the community.

Mr. James Dillon a Donegal TD vigorously opposed the Central Bank Act1942.

Random quotes from James Dillon TD in the Dáil debate.

Mr. Dillon: I am out to prove now (1) that credit money exists; and (2) that that credit money belongs to us and not to the joint stock banks, and that we and not the board of directors of the joint stock banks should be the authority to determine what is to be done with that asset.

Mr. Dillon: I am talking about credit money and I want to demonstrate what credit money is. I say that it is the very heart and soul of the Bill— where the ownership of that credit money lies. I say that the Bill places that ownership with the joint stock bankers. I contend that it is our property and surely I am entitled to claim that it is? On what other Stage can I deal with it. I am saying that what is in the Bill is the allegation that that money belongs to the bank. I am claiming it now for myself and my fellow-citizens. Is that not in order?

Full debate in the Dáil:

Dáil Éireann – Volume 88 – 17 July, 1942 – Committee on Finance. – Central Bank Bill, 1942—Fifth Stage. (Seán T O’Kelly is referred to as Mr. O Ceallaigh in the debate)

A more detailed article on the subject of the passing of The Central Bank Act-1942, is available on Beacon-Ireland website.